Multiple Deployment Options

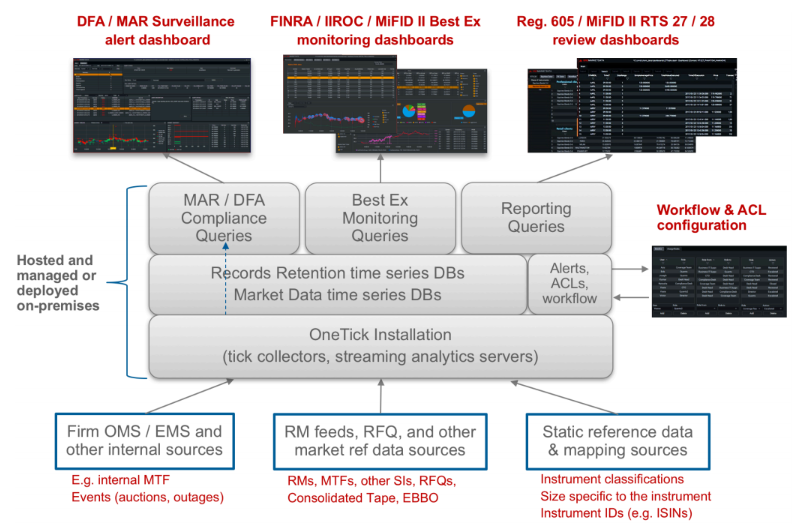

The OneTick Trade Surveillance solution is a fully packaged solution that can be deployed in-house or as a hosted subscription service fully managed by OneMarketData.

OneTick includes coverage of MAR, MiFID II, SEC, FINRA, and IIROC trade surveillance regulation.

OneTick Trade Surveillance's smart features make it easy for trading supervisors and compliance officers to zero in on, investigate, and act on anomalies.

The OneTick Surveillance solution, built on top of the OneTick proprietary tick database and stream processing platform, delivers robust, configurable built-in alerts to support executing brokers: layering and spoofing, quote stuffing, wash trading, marking the close, and more.

Combine our built-in alerts with your own and see how the OneTick Surveillance solution can deliver exactly what you need: continuous examination of order flow, advanced visualizations, case management, high performance, and low TCO. You can easily add new alert definitions using the OneTick model construction tool.

Designed for the efficient review of surveillance alerts, rapid examination of new alerts, and for assigning, reviewing, annotating, and archiving them as part of an auditable resolution workflow.

OneTick includes coverage of MAR, MIFID II, SEC, FINRA, CFTC, ASIC, and IIROC trade surveillance regulation.

The OneTick Trade Surveillance solution is a fully packaged solution that can be deployed in-house or as a hosted subscription service fully managed by OneMarketData.

Outsource your trade surveillance and compliance obligations at a cost far below in-house development and competitive products.

Includes real time / intraday alerts through visual dashboards and email notifications and T+1 reports.

OneTick Surveillance includes an extensive library of standard alert types. Alert types have parameters that allow their behavior to be tuned to specific flows.

Logic of standard alerts can be customized per client's requirements and custom alerts types can be integrated seamlessly.

OneTick Surveillance is built on top of the industry-standard tick management platform OneTick and can handle volumes of the largest market participants and exchanges.

The OneTick platform provides a modeling tool for the rapid design, development, and deployment of custom surveillance alerts.

Our philosophy is to minimize the number of clicks required to investigate alerts and manage workflows.

The web-based dashboard has been designed for efficiency and is used daily by trade supervisors and compliance staff all over the world.

Alert types have parameters that allow their behavior to be tuned to specific flows, and also allow a single alert type to represent what would be several distinct alert types in other commercial systems.

Detection of one or more orders on one side of the market that appear to have been entered without an intention to execute on that side. May be combined with the posting of one or more orders that would benefit by interacting with flow induced to cross the spread by the layered influencing orders. Eleven parameters control such tolerances as the maximum duration of stages of the potential spoofing activity, distance from the market, sensitivity to intervening fills, various size thresholds, and behavior with respect to partial fills. [MAR Annex I A(e) / TA 2.3.10(e)]

Posting orders without the intent to trade. A.k.a. Avoiding priority. This is an aspect of Layering and Spoofing. [MAR Annex I A(f) / 2.3.11(a), also ‘Avoiding Priority’]

A spoofing variation in which the manipulative order induces other participants to join it, and the benefiting order is an aggressive takeout that interacts with the induced orders. [MAR Annex I A(f) / 2.3.11(a)]

Similar to Post and Cancel. Post to attract slow traders, then fade price. [MAR Annex I A(f) / 2.3.11(j)]

Improving bid when bid is reference price for position. An aspect of Layering and Spoofing. May be combined with a benefiting position rather than order. [MAR Annex I A(f) / 2.3.11(d)]

Simultaneous buys and sells of the same financial instrument, for the same beneficial account. Parameters control timing and price tolerances. [MAR Annex I A(c) / TA 2.3.8(a)]

Similar to Wash Trades, but involving customer orders. Matched orders are orders for the sale or purchase of any such security where a corresponding order of substantially the same size, at substantially the same time, and at substantially the same price, for the execution of the other side has been or will be entered by or for the same or different parties. [MAR Annex I A(c) / TA 2.3.8(c)]

Detection of a manipulative practice in which non-bona fide orders or quotes are entered and cancelled at a high rate, with the effect of creating non-informative market data traffic. The orders may be entered on one or both sides of the market. Parameters control sensitivity to cancellation / update rate, the duration of the observation window, and the effects of intervening fills. This alert can be parameterized to detect other ‘excessive rate’ conditions. [MAR Annex I A(d) / TA 2.3.9(e)]

Similar to Quote Stuffing, but on the trade tape. Rapid trading solely to give the impression of trading interest. [MAR Annex I A(c) / TA 2.3.8(b)]

Detection of a manipulative practice in which a trader attempts to artificially influence the official closing price of a security or derivatives contract by placing orders / quotes or executing trades at or near the close of normal trading hours, potentially to influence a position mark, a derivative price, or the trade price for a market-on-close order the trader is holding. Parameters support variants for markets with closing auctions and markets with fixing period rules, futures closing range, etc. Other parameters control sensitivities to manipulative order size, aggressiveness, and participation rate. [MAR Annex I A(a) / TA 2.3.6(b)(ii, iii), more generally ‘Benchmark Manipulation’]

The alert is raised when a trader placed orders ahead of a watched trader.

Trigger on single or multiple orders that are large relative to the total liquidity in the top N levels of the market’s published order book may potentially distort the market. Distortive orders placed in conditions such that they are unlikely to fill, or cancelled before filling, could signal another manipulative practice such as spoofing. Parameters control tolerance to relative size, distance from market, etc.

Trigger an alert when traded volume is large relative to the total volume traded on the market.

Trigger an alert when the order-to-fill ratio exceeds a given threshold in a given time window.

Within a defined time period, the alert should trigger off either a large number of passive orders submitted only (e.g. 10 DAY orders ) / OR a large number of aggressive trades executed (e.g. 10 IOC trades) in quick succession, followed by a defined price movement (e.g. 0.5%), with the orders/trades in the direction of the price movement only (e.g. only BUY orders/trades for upward price movements or SELL orders/trades for downward price movements). This alert should not trigger off BUY orders/trades when the price decreases– i.e. a false positive.

Within a larger time period than the Momentum Ignition Alert, this alert should trigger off a significantly larger number of aggressive trades only, not orders (e.g. 50 IOC trades), during a defined price movement (e.g. 2%), with the trades being in the direction of the price movement only. (e.g. only BUY trades for upward price movements etc.) Also, the percentage of trades on the opposite side should be less than 10% of the Number of Directional Trades (MIN_ORDERS_NUM) parameter.

Entering small orders to trade in order to ascertain the level of hidden orders and particularly to assess what is resting in dark pools. A Pinging alert is raised when a trader enters an order with the quantity less than MAX_QTY at a price that's better than the aggressive touch.

An alert is raised when an order was sent to exchange when it was halted with LULD (Limit-Up-Limit-Down) condition.

An alert is raised when a trader submits an MOC/LOC order after the cutoff time.

An alert is triggered when SHORT_SELL order was sent to exchange with empty Locate Broker Tag

Buy ahead and push the market to sell to a client through stop loss. Also known as ‘gunning the market’ and ‘running the stops’. Variants support both the case when the participant is a market-maker with a book of known stop orders, and the the case when a trader may be ‘hunting’ for stop orders hidden in a public limit order book. Parameters control sensitivity to distance between potential trigger orders and known stops, size rations, and participation rates.

Use a take-profit order as a "free" stop loss order by placing orders at prices slightly better than the take profit price. Parameters control relative size and price tolerances.

Stop Loss or Take Profit were not executed even though they should have been. Parameters control trigger delay and whether market price must cross the trigger price.

Buy ahead and push the market to sell to a client through stop loss. Also known as ‘gunning the market’ and ‘running the stops’. Variants support both the case when the participant is a market-maker with a book of known stop orders, and the the case when a trader may be ‘hunting’ for stop orders hidden in a public limit order book. Parameters control sensitivity to distance between potential trigger orders and known stops, size rations, and participation rates.

The alert is raised when an order (typically client's Stop Loss or Take Profit order) is executed away from the limit rate.

Stop Loss or Take Profit were not executed even though they should have been.

Customer orders with same economic details were not executed in the order they were received.

Partial Fill alert is raised when an executed principal / MM order is followed by a partial fill to a client.

Report on reserve or iceberg orders submitted by traders

The Reg NMS Rule 611 Trade Through alert is raised when one of the orders in an ISO wave was not executed at the best possible price according to quoted prices on other exchanges. If a better price is quoted elsewhere, the trade must be routed there for execution, and not traded through at its current exchange.

This alert is raised when a corporate announcement is associated with a previously accumulated exposure. Optionally, the alset can be configured to take position liquidation into account.

This alert is raised when an extraordinary return is associated with a previously accumulated exposure. Optionally, the alert can be configured to take position liquidation into account. This alert type may be used as a substitute for the news-based Insider Trading alert type when a news feed is not available.